Stephanie’s Mortgage Rate Update

Written by Stephanie Robello

There has been a notable shift in the Federal Reserve’s stance on monetary policy, with anticipation now set for 3 or 4 rate cuts in 2024, reflecting a more aggressive approach compared to previous outlooks. Following their third consecutive meeting, the Fed has decided to maintain current rates, signaling an end to rate increases for this cycle and a forthcoming cycle of rate reductions. Looking ahead, the Fed projects 4 rate cuts in 2025 and an additional 3 in 2026.

The timing and extent of these rate cuts remain uncertain, with forecasts ranging from a reduction of up to 200 basis points to as low as 75 basis points. Bond expert Jeffrey Gundlach predicts a 10-year yield of 3% in 2024, a notable shift from previous levels, which were over 5% just a few months ago, and around 4.244% this morning (2/15).

It’s important to note that despite the current Fed Funds rate ranging from 5.25% to 5.50%, it remains relatively restrictive due to the trajectory of inflation, which is expected to trend lower. Additionally, ongoing sales of treasuries and bonds further constrain monetary policy. The next anticipated step for the Fed would involve halting these sales, as it would be counterintuitive to lower rates while divesting these assets. The cessation of sales is expected to naturally lower rates, with the possibility of further rate reductions through quantitative easing measures.

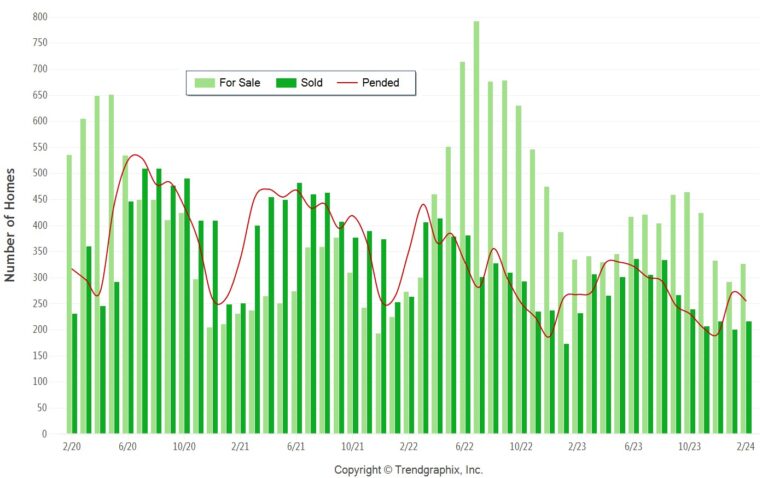

Mortgage bonds have experienced a significant increase of 70 basis points, indicating a positive trend. However, market performance tomorrow may see some profit-taking, potentially leading to a slight retreat in rates. Nevertheless, the current outlook suggests favorable conditions for lower mortgage rates, signaling a return to a more normalized market environment for home purchases in 2024.